2x Your Net Worth Through Strategic Upgrading

Remove the guesswork with clear data & framework proven for success

Why upgrading feels risky (and why most people hesitate)

Upgrading is not simply “selling high and buying higher.” The stress usually comes from uncertainty in four areas:

Fear of losing money when selling your current home or buying the next one at the wrong entry price

Fear of overstretching during the transition period (especially if timelines shift)

Confusion between resale vs new launch, and what you are truly trading off

Uncertainty about what makes a condo perform, beyond tenure, MRT distance, and marketing narratives

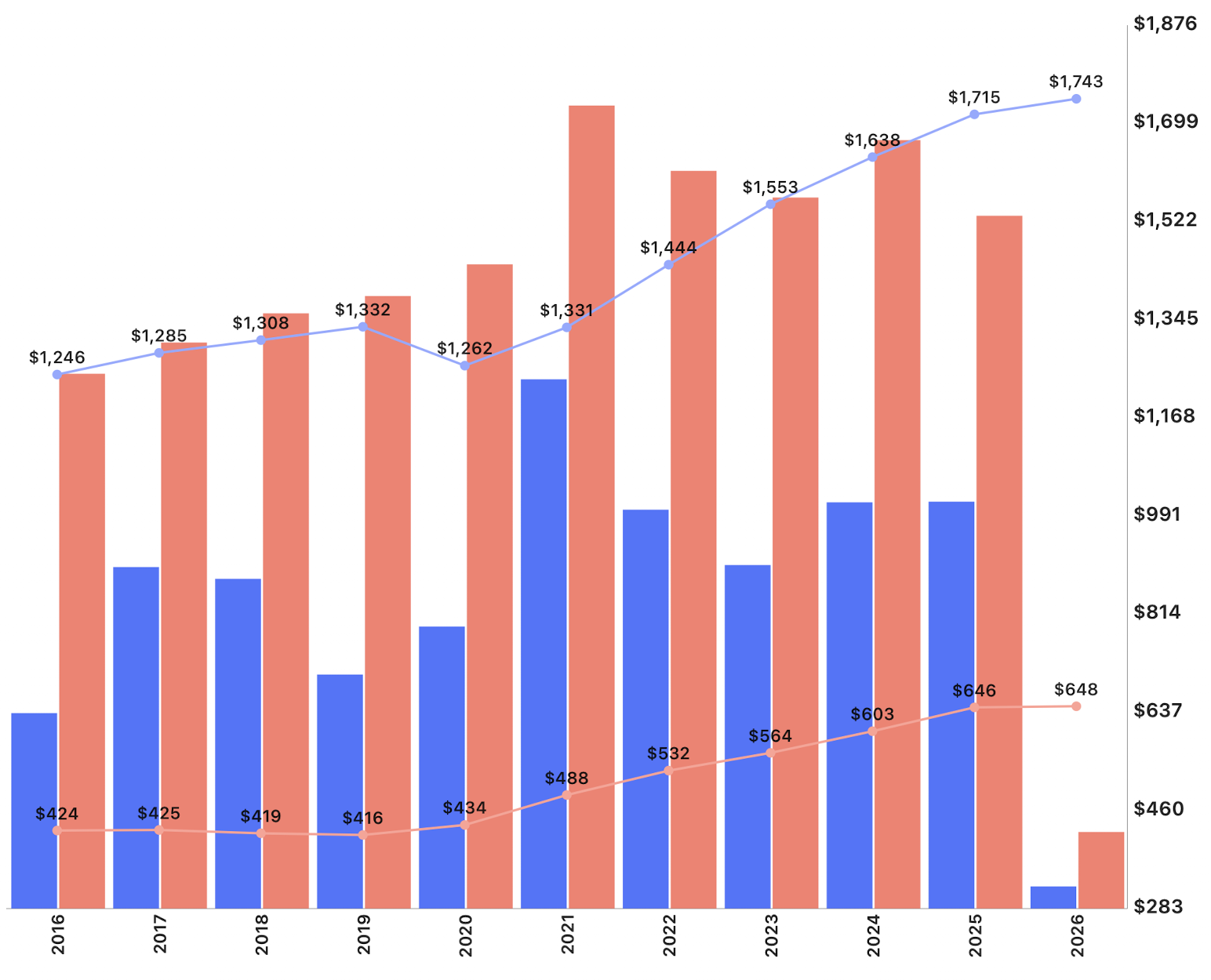

The cost of “waiting”

Many times homeowners tell me that “prices are too high”, or “i’ll wait for prices to drop” first.

It is completely normal, but here’s an illustration to show that by taking small steps, you can unlock more capital appreciation on your asset, and gradually building wealth.

2020 - Net worth $800,000

Mr & Mrs Lim have stayed at their matrimonial 4-room home in Bedok for 5 years and decided to sell their unit after MOP.

Cash proceeds from sale: $350,000

They then purchased a 5 room HDB for $950,000

2025 - Net worth $950,000

The couple then moved to a larger 5-Room and grew a family, they decided that it was a good time to upgrade to a condo.

Cash proceeds from sale: $150,000

They then purchased a condo for $1.5M

Presently - Net worth $1,500,000

The couple has since upgraded to a 3-Bedroom condominium.

Assuming the couple continues to stay here and fully pays up their loan, they have 2x their own net worth.

Upgrading your asset creates retirement certainty.

A good question to ask yourself is: How much spare funds would you need when you retire?

While you may have investments and savings, generating wealth through assets is a useful tool when done right to unlock a healthy retirement.

In the case of Mr & Mrs Lim, should they retire and right-size to an apartment worth $500,000:

Option A:

Upon selling their 5-room HDB (worth $950,000), they would have excess retirement funds of $450,000 after their home purchase.

Option B:

Upon selling their 3-Bedroom Condo (worth $1,500,000), they would have an excess of $1,000,000 for their retirement needs.

Which scenario would you prefer to be in for your retirement?

The Upgrade Framework

How do you successfully take the next step?

Whether you are looking to upgrade to a private property or a larger HDB, there are a few key fundamentals that you need to consider.

Our clients have benefited from their property upgrade by simply adhering to the following framework of fundamentals:

Affordability

A safe upgrade starts with a thorough financial assessment exercise. By knowing your affordability, you should be able to:

Understand your budget after TDSR & MSR calculations

Upgrade to your next property without overstretching

Have enough emergency funds to weather market conditions

Have peace of mind

Entry Price

Why do some upgraders make more profit than the rest? They simply take advantage of the right entry price.

Sell high and buy low

The right entry price allows sufficient buffer for profit margins

Learn how to spot undervalued and affordable properties

Trends are shifting - high floor, doesn’t always mean more profit

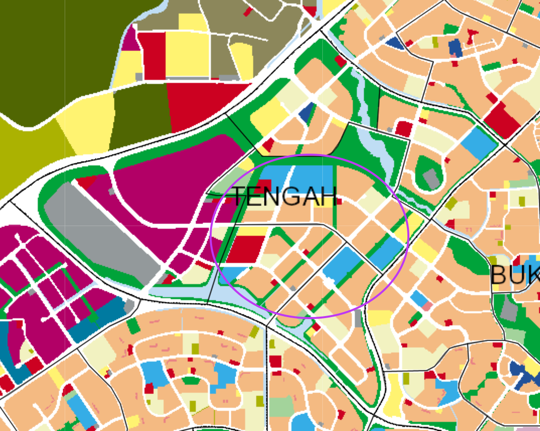

Exit Strategy

Who are your future pool of buyers? Will your next home be able to command a higher price when you sell in the future?

Understand the impact of government policies on home prices

Are there any future development that can push your prices up?

For units purchased with tenancy in mind, are the units that you are shortlisting favoured by tenants within the rental bracket?

Book a discovery call to find out your options

✔ A recommended upgrade route based on your current situation (HDB → Condo / Condo → Bigger Condo / Condo → New Launch / Condo → Landed)

✔ A safety-based affordability range that includes a buffer (not just maximum loan)

✔ A resale vs new launch recommendation aligned to your timeline and risk profile

✔ A shortlisting approach for projects and units that fit your numbers and exit logic

✔ A clear “next best move” plan, including what to do now and what to avoid

This is a structured consultation designed to give you clarity and a practical next step.

Important: This session is complimentary and non-obligatory. I do not believe in pushing projects to clients, instead I ensure each session is collaborative.

What is your ‘Why’?

Hi there! If you’ve scrolled all the way here, I should probably introduce myself.

My name is Sadali and my approach to real estate is tailored to every client.

So…what’s your ‘why’?

Whether you are looking to buy, sell or upgrade your property, i’ll guide you in your journey to ensure that you achieve the right home that ticks all the boxes for the things that matter to you and your family.