Is Vela Bay a Smart First-Mover Advantage, or a Pricey Purchase? [New Launch Review]

Artist’s impression of Vela Bay. Note: Not confirmed and subject to changes

Why Is Bayshore Exciting?

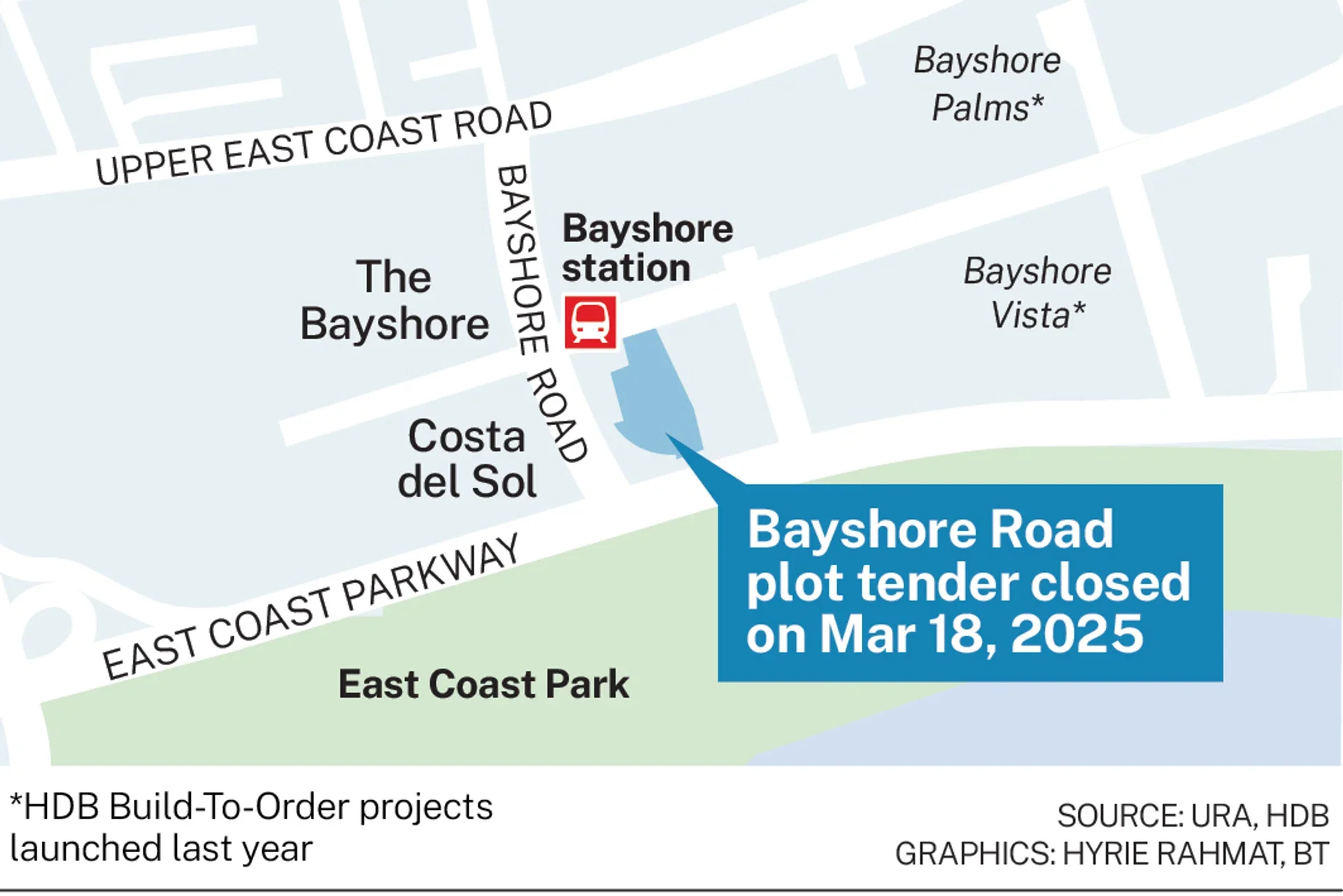

Ever since the government announced the Bayshore precinct, many Singaporeans have been watching this stretch of the East with renewed interest.

It isn’t just another small infill plot — it is a full-scale township plan with approximately 10,000 residential homes, of which around 3,000 are private properties.

On top of that, the area is set to feature an integrated transport hub and the largest SAFRA in Singapore, which immediately elevates the long-term lifestyle proposition. This is layered onto an already well-loved coastal precinct that has consistently attracted both locals and expatriates over the years.

Source: HDB

Unlike brand-new towns that require years before basic amenities mature, Bayshore is an extension of an existing, functioning East Coast ecosystem. That alone reduces a significant layer of uncertainty that typically comes with large transformation stories.

Where Does Vela Bay Stand?

Vela Bay is the first private launch within this newly announced precinct, comprising 515 units and directly linked to Bayshore MRT Station.

Being the first mover automatically gives it benchmark-setting power — but it also means it carries the responsibility of proving the price narrative for the entire estate.

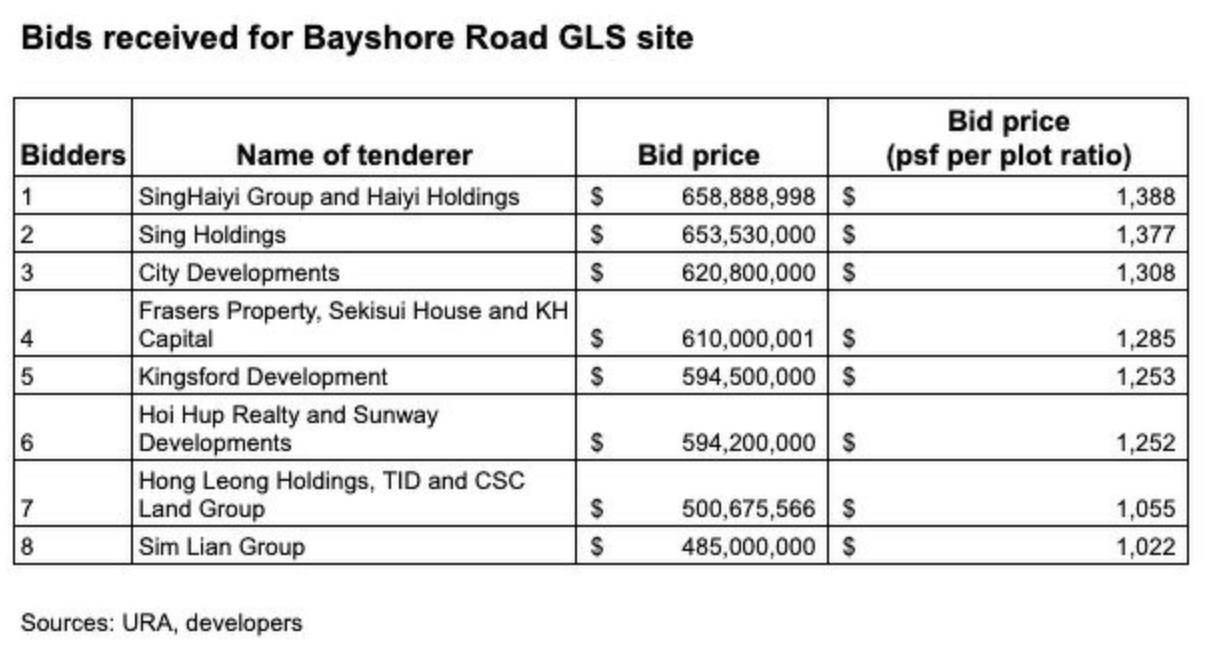

Source: Business Times

The land was acquired at approximately $1,338psf by SingHaiyi Group, whose bid came in at the highest out of 8 in total.

The difference between the top two bidders came down to a mere $11psf!

Given the high number of developer bids for this project, it is also a testament to the developer’s confidence in the success of this project.

So how does the land price compare to other recent land sales in the OCR region?

| Land Site | Development Name | Region | Land Bid Price ($ psf ppr) |

|---|---|---|---|

| OCR (Outside Central Region) | |||

| Canberra Crescent GLS | Canberra Crescent | OCR | 793 |

| Tampines Avenue 11 GLS | Parktown Residence | OCR | 885 |

| Upper Thomson Road (Parcel B) GLS | Springleaf Residence | OCR | 905 |

| Lakeside GLS | TBC | OCR | 1,132 |

| Bedok Rise GLS | TBC | OCR | 1,330 |

| Bayshore Road GLS | Vela Bay | OCR | 1,388 |

| RCR (Rest of Central Region) | |||

| Margaret Drive GLS | Penrith | RCR | 1,154 |

| Clementi Avenue 1 GLS | Elta | RCR | 1,250 |

| Lorong 1 Toa Payoh GLS | The Orie | RCR | 1,360 |

| CCR (Core Central Region) | |||

| Zion Road (Parcel A) GLS | Zyon Grand | CCR | 1,202 |

| Holland Drive GLS site | Skye at Holland | CCR | 1,285 |

| Zion Road (Parcel B) GLS | Promenade Peak | CCR | 1,304 |

| River Valley Green (Parcel A) GLS | River Green | CCR | 1,325 |

| Marina Gardens Lane GLS | One Marina Garden | CCR | 1,402 |

The land cost is definitely the highest out of all OCR land sales, however as we’ll come to find out later, these prices are not entirely out of context for the bayshore precinct.

Given the land cost of $1,388 and after adding developer’s profit margins of an est $1,300 psf, we are expecting a launch psf of $2,700 onwards.

Are You Paying a Premium?

Vela Bay is the first private launch in the immediate Bayshore area in more than 20 years. Over that time, the surrounding projects — Costa Del Sol, The Bayshore, and Bayshore Park — have aged, yet transaction activity remains strong.

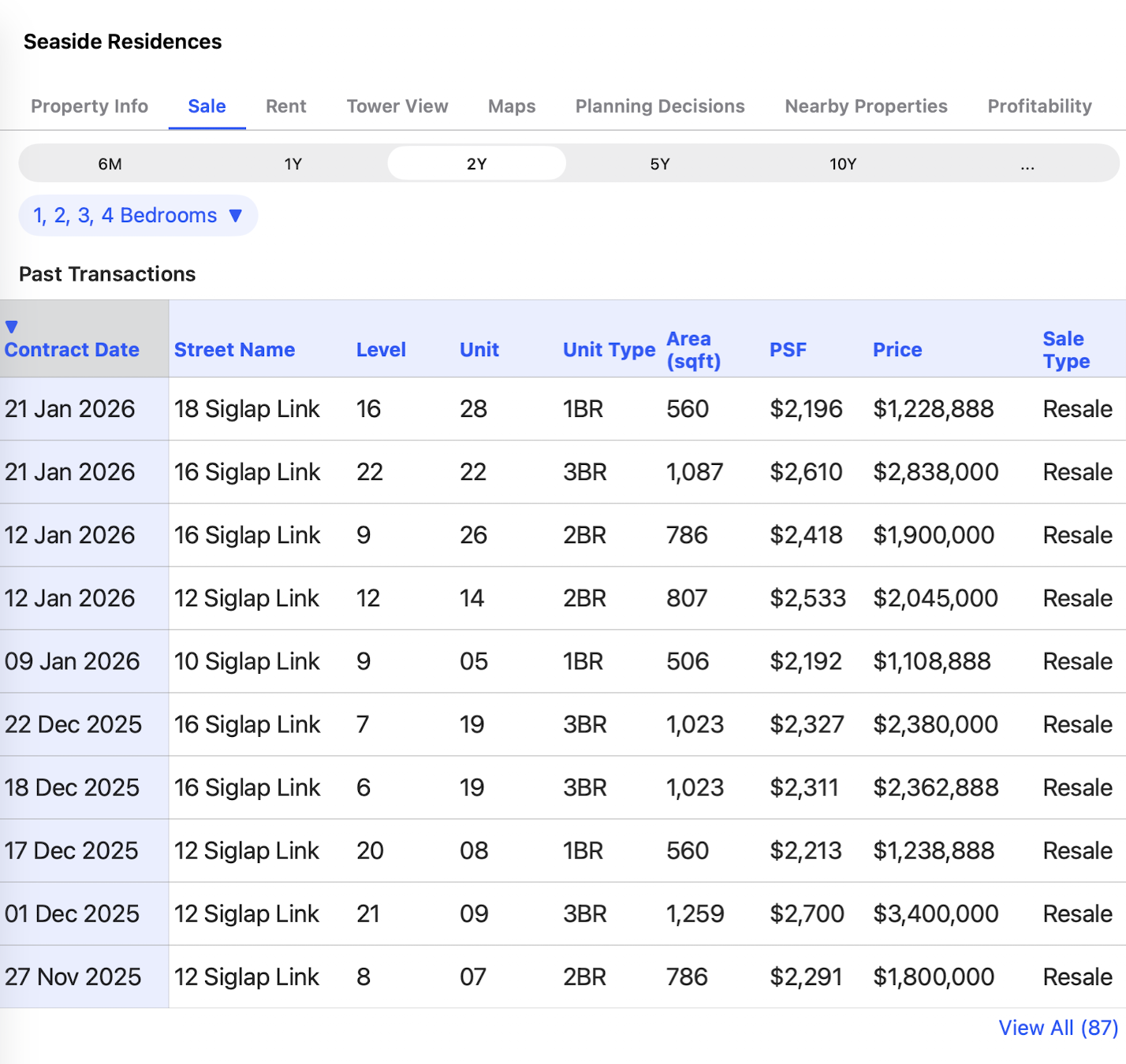

(Above) Transaction data from Seaside Residences

From a resale perspective, demand in this coastal belt has remained resilient. Seaside Residences, for example, has seen three-bedroom units transacting around $2,600 psf, with at least one transaction touching $2,700 psf.

If resale units are already transacting near projected launch pricing, then the question shifts. Are you really paying a huge premium, or are you entering at a price that the surrounding market has already validated?

Fundamentally, property investment is about buying at a level where higher benchmarks already exist or are likely to be established. In this case, Vela Bay is launching into a submarket where comparable transactions have already approached similar numbers — while offering brand-new facilities, modern layouts, potential sea views, and a fresh 99-year lease.

That combination matters.

How Long Will the Transformation Take?

One common concern with transformation plays is timeline risk. We have seen projects marketed on the promise of large-scale redevelopment — such as the Greater Southern Waterfront — where progress has been slower than initial excitement suggested.

That is what makes entry tricky. Buyers price in future upside, but resale buyers may not reward that upside until visible change materialises.

In Bayshore’s case, however, the government appears to be pushing forward with clear staging, with the precinct slated for progressive development through the mid-2030s. Two BTO projects are already under construction, which signals that the residential component is not merely conceptual but actively underway.

That does not mean appreciation will be immediate. It means the transformation narrative has started moving.

More Land Plots = More Capital Appreciation?

In theory, rising land costs can create upward pressure on future launch prices. There is an upcoming Government Land Sale plot closer to Bedok South MRT that is expected to be integrated with transport infrastructure, and such integrated sites typically command stronger bids.

If that future plot transacts at a higher land rate, it strengthens the benchmark for earlier projects like Vela Bay. At the same time, we can reasonably expect two to three more private GLS sites to be rolled out to fulfil the approximately 3,000 private homes announced for the precinct.

URA masterplan showing the different plots available around Vela Bay

The key here is pacing. If plots are released progressively and at rising land rates, early buyers benefit from benchmark stair-stepping. If too many sites are released too quickly, short-term competition increases and appreciation may take longer to materialise.

Capital appreciation is rarely linear. It tends to follow land cost direction and supply sequencing.

My Opinion

If you ask me, Vela Bay is likely to see strong interest because coastal properties in Singapore have historically enjoyed consistent demand. This is not a fringe experiment — it is a rare new private launch in a matured, seaside district with structural MRT connectivity.

That said, I would not call it an automatic win for everyone. It makes the most sense for buyers with a medium- to long-term horizon who understand that transformation takes time and who have sufficient financial buffer to ride out short-term fluctuations.

At around $2,700 psf, it is not “cheap.” But when resale projects nearby are already approaching similar price levels, and when future integrated plots may set even higher benchmarks, it becomes less about absolute price and more about relative positioning.

For buyers seeking a brand-new development with modern facilities, coastal proximity, and what could be considered a defensible entry benchmark, Vela Bay deserves serious consideration. The real question is not whether it will sell — it is whether your holding horizon aligns with the pace of the precinct’s evolution.